Quantzee AI

Adaptive Quant Toolkit

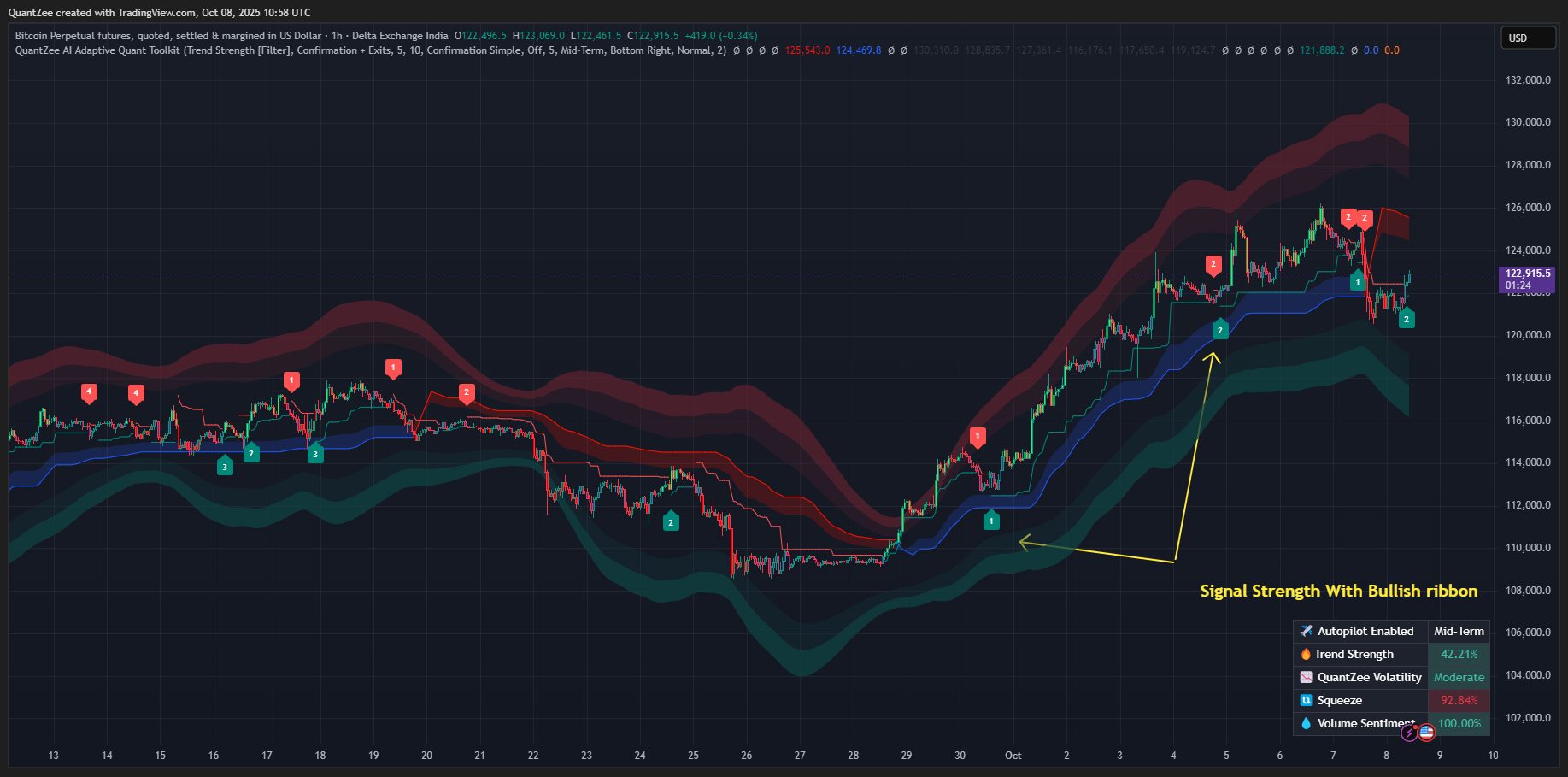

Adaptive signals, overlays & market intelligence powered by QuantZee

The QuantZee AI Adaptive Quant Toolkit is a next-generation trading framework that fuses adaptive signal generation, contextual overlays, and a live analytics dashboard into one clean, actionable system.

Developed using proprietary QuantZee Adaptive Intelligence, this toolkit merges algorithmic signal generation, machine-driven optimization, and multi-layered visual analytics to deliver an actionable, data-driven trading experience.

Unlike conventional indicators that rely on fixed formulas, QuantZee AI Adaptive Quant Toolkit dynamically tunes itself to evolving volatility, trend structure, and volume patterns — creating a truly adaptive environment suitable for all market conditions

Whether you are a scalper, swing trader, or trend follower, this single framework integrates multiple modules—each powered by advanced quantitative logic—to generate high-probability buy/sell signals, identify trend reversals, and visualize market structure overlays in real time.

It’s not just an indicator; it’s a complete AI-assisted decision-support system for traders.

Purpose & Design Philosophy

QuantZee’s mission is to bridge human intuition with algorithmic precision.

Every component of Adaptive Quant Toolkit is designed to serve a specific analytical purpose:

Signal Layer: Detects transitions in momentum and trend state with adaptive sensitivity.

Overlay Layer: Displays dynamic support/resistance and trend context using QuantZee’s SmartTrail, TrendCatcher, TrendTracer, and NeoCloud.

Intelligence Layer: Applies machine-learning-style classification to rank signals by strength and reliability.

Dashboard Layer: Monitors real-time trend strength, volatility, volume sentiment, and market compression (“squeeze”).

The result is a modular AI ecosystem that adapts automatically—allowing traders to simplify their chart, reduce noise, and act with clarity

Core Capabilities

Multi-Factor Signal Engine

The system uses an adaptive Supertrend matrix scanning dozens of ATR multipliers, evaluating their performance in real time via QuantZee’s clustering algorithm.It identifies which parameter range historically produced the cleanest signal behaviour, then automatically tunes itself (“Autopilot”) for current volatility.

The result — an intelligent signal generator that self-optimizes per market phase.

AI Signal Classifier

Every signal is automatically graded from Level 1 → Level 4, reflecting expected quality and continuation probability.

Higher-level signals indicate stronger momentum alignment, while lower levels may highlight early-stage reversals or retracements.

This lets users filter or prioritize only high-confidence setups.

Candle State Visualization

The integrated AI Candle Engine uses an enhanced MACD-gradient algorithm to visually map trend momentum on each bar.

Green-to-red gradients represent strength and weakening; Contrarian Mode inverts the colour logic for mean-reversion strategies.

Preset Profiles

Quick-access templates built for different trading styles:·

Trend Trader Mode: Activates Smart Trail, Trend Catcher, and Neo Cloud to track strong directional moves.

Scalper Mode: Focuses on short-term sensitivity and rapid gradient transitions.

Swing Mode: Expands signal horizons for positional setups.

Contrarian Mode: Highlights potential reversals with inverted candle logic and Reversal Zones..

Each preset modifies internal parameters and visual components in one click, allowing new traders to start quickly and professionals to fine-tune deeper.

Core Signal Engine

- Autopilot Sweep: Evaluates ATR multipliers and computes a performance index on directional P/L.

- Cluster Optimization: Groups results via adaptive clustering and selects the optimal multiplier cluster.

- Dynamic Output: Generates a self-tuning Supertrend, Adaptive MA, and Trailing Stop.

- AI Classifier: Ranks each signal (Level 1–4) by continuation probability.

- Trend Filter: EMA50/EMA200 alignment upgrades valid signals to “+” status.

Optional filters gate signals using overlay direction, cloud momentum, or trend-strength thresholds, allowing a cleaner and more confident read of price action.

Advanced Overlays & Tools

Smart Trail

A dynamic trailing structure that adapts to short-term momentum shifts.

Acts as both a trailing stop and visual trend channel.

Trend Catcher

QuantZee’s colour-coded hybrid trend tracker built for directional confluence with primary signals.

Green = up-trend bias, Red = down-trend bias.

Trend Tracer

Pinpoints micro-reversals inside broader moves—useful for detecting exhaustion, pullbacks, or trend continuation phases.

Neo Cloud

An evolved, AI-filtered Ichimoku derivative built on volatility-weighted smoothing and adaptive ATR envelopes. The cloud helps identify momentum zones, dynamic supports/resistances, and bull-bear transitions across any timeframe.

Reversal Zones

An intelligent mean-reversion channel generated using Ehlers-style SuperSmoother filters and true-range-based volatility envelopes. It shades overbought/oversold regions and dynamically updates to price structure, making it ideal for contrarian setups and exit planning.

Candle Intelligence MACD-driven candle colouring in Confirmation, Contrarian, or Simple modes.

TP/SL Projection Boxes Forward volatility-based take-profit/stop-loss zones with guides.

Session Visualizer London / New York range boxes and intraday high-low levels.

QuantZee Dashboard

A compact analytics panel providing:

- Trend Strength Index

- Volatility Heatmap

- Squeeze (Compression) Metric

- Volume Sentiment

- Autopilot Status

All metrics update live, offering a quant-style view of underlying market health.

TP/SL Projection Boxes

Optional future-projected Take-Profit / Stop-Loss areas derived from volatility expansion models—helpful for visually planning exits.

Session Visualizer

Highlights key market sessions (London/New York) with live high-low boxes and labels to contextualize intraday range behaviour.

Preset & Quick Modes

| Mode | Ideal For | Description |

| Trend Trader | Trending markets | Enables Smart Trail, Trend Catcher, Neo Cloud, Trend Tracer |

| Scalper | Fast markets | Higher sensitivity, gradient candles |

| Swing Trader | Positional trades | Wider horizon, smoother context |

| Contrarian | Ranges / fades | Activates Reversal Zones™ & Contrarian colouring |

Intelligent Filters

Each generated signal can be validated or suppressed through intelligent filters:

- Smart Trail Filter: Signals only appear when aligned with Smart Trail direction.

- Trend Strength Filter: Only show signals in strong trending conditions.

- Trend Catcher Filter: Requires alignment with the Trend Catcher overlay.

- Neo Cloud Filter: Uses momentum state inside Neo Cloud for confirmation.

- Trend Tracer Filter: Signals must match Trend Tracer direction.

These filters act as conditional gates — giving traders the flexibility to balance signal frequency vs. accuracy.

AI AutoPilot — Self-Optimizing Engine

The Autopilot Sensitivity setting allows QuantZee AI to automatically adjust all underlying ATR ranges and internal parameters based on the current market environment:

| Mode | Optimized For | Typical Use |

| Short Term | Trending markets | Enables Smart Trail, Trend Catcher, Neo Cloud, Trend Tracer |

| Mid Term | Fast markets | Higher sensitivity, gradient candles |

| Long Term | Positional trades | Wider horizon, smoother context |

When active, Autopilot continuously refines internal parameters for cleaner, more relevant signals — making the system self-adjusting without user tuning.

Usage Strategies

- Confirmation Mode

1. Use standard signals + candle coloring for trend confirmation.

2. Combine with Smart Trail or Trend Catcher for confluence. - Contrarian Mode

1. Use Reversal Zones + Contrarian Gradient candles to fade extremes.

2. Best for range-bound or mean-reversion markets. - Trend Optimization

1. Enable Autopilot (Long Term) + Trend Strength Filter.

2. Focus on confirmed high-probability trends. - Intraday Scalping

1. Enable Scalper Preset + Smart Trail Filter.

2. Combine candle gradients + Trend Tracer for entry alignment.

Key Differentiators

| Feature | QuantZee AI Adaptive Quant Toolkit | Generic Toolkits |

| Self-Learning Autopilot | ✅ Yes (K-Means Clustering + Performance Index) | ❌ Static |

| AI Signal Classifier | ✅ Level 1-4 grading | ❌ Basic signals only |

| Adaptive Overlays | ✅ SmartTrail, NeoCloud, TrendCatcher, etc. | ❌ Limited |

| Dynamic Dashboard | ✅ Multi-metric live data | ❌ No built-in analytics |

| Multi-Filter Framework | ✅ 5+ filter types | ❌ Fixed conditions |

| Visualization System | ✅ Full candle, cloud, and zone layers | ❌ Basic plotting |

Key Inputs

Core

- Show Signals — Toggle entry labels.

- Presets / Filters — Quick configuration for styles or confluence gates.

- AI Signal Classifier — Display 1-4 confidence levels.

- Signal Sensitivity — Controls ATR scan range (1–26).

- Signal Tuner — ATR length for the sweep and final output.

- Candle Coloring — Confirmation, Contrarian, Simple, or None.

Overlays & Dashboard

- Toggle Smart Trail, Trend Catcher, Trend Tracer, Neo Cloud, Reversal Zones, Dashboard, Trailing Stop, AI MA, Sessions.

Advanced

- TP/SL Points — Enable forward boxes.

- Autopilot Sensitivity — Short-, Mid-, or Long-Term auto-tuning.

- Dashboard Location / Size — Layout controls.

Why Traders Choose the QuantZee AI Adaptive Quant Toolkit

- Self-tuning logic (adaptive clustering + performance indexing)

- Modular overlays & intelligent filters

- Real-time AI Classifier with confidence grading

- Multi-metric live dashboard

- Works on all markets & timeframes

- Clear, quant-style visualization

CPR Theta Engine FAQ

It’s a TradingView indicator built for high-probability option selling using Central Pivot Range (CPR) logic. It automatically identifies optimal setups to sell Calls, Puts, or Iron Condors based on CPR-based price positioning.

Yes, it is optimized for index options due to:

- CPR’s high relevance in index movement,

- Iron Condor suitability for range-bound days,

- Customizable spread width and strike rounding compatible with Indian derivatives tick sizes.

Yes, This indicator always gives the signal with the hedge. You should always use hedge while using this script.

You can apply the same script across multiple TradingView charts (NIFTY, SENSEX, RELIANCE etc).

Each will:

- Auto-calculate its own CPR and strike logic,

- Maintain instrument-specific strike rounding and logic zones.

Yes, you can select custom timeframes and apply the strategy to both intraday and weekly positional setups

Yes. It simplifies the decision-making process using visual cues and rule-based logic while allowing deeper customization for advanced users.

Yes. Use the custom settings to restrict the backtest range or apply the indicator to different instruments like NIFTY, BANKNIFTY, or FINNIFTY.